So you are looking for yield but are struggling to find in a market where there is too much money floating around for too few deals. Personally I don’t care to pay 7x SDE for a company under $5M in revenue or 10x sales for a microSaaS, in a market I don’t understand. There is another investment class that you may not have considered and that’s distressed debt; whether it’s public or becoming a professional note buyer (PNB), acquiring loans from special asset bankers. Let’s take a look on how to value the loans using an example that I currently working on (of course I have to keep the names of the company confidential but the numbers are real)…

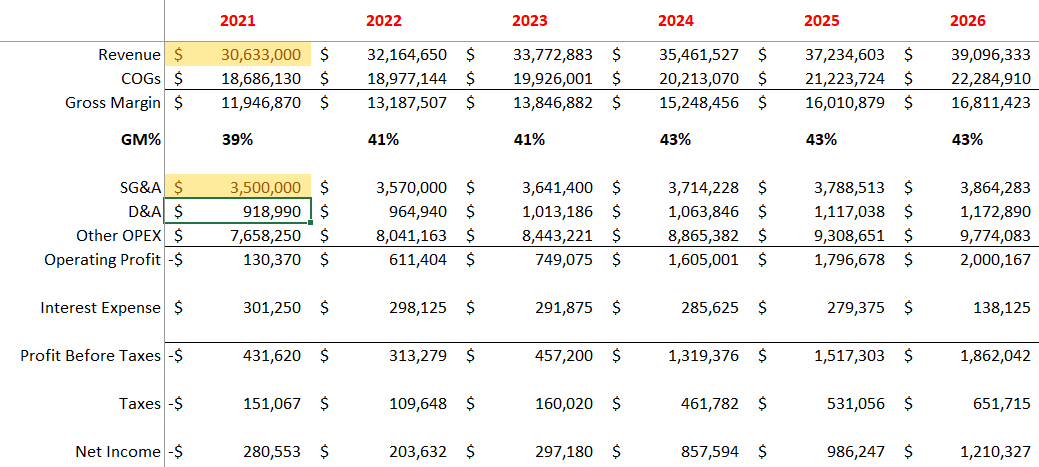

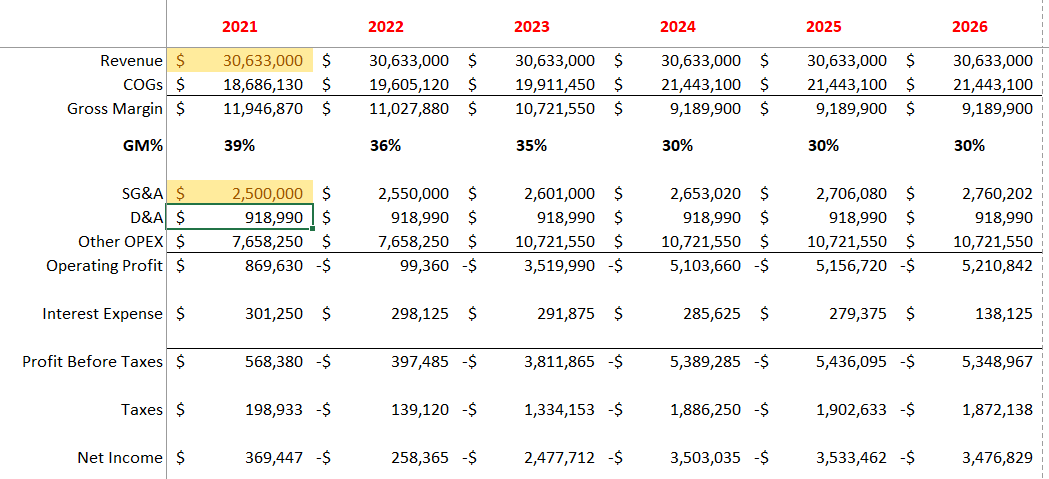

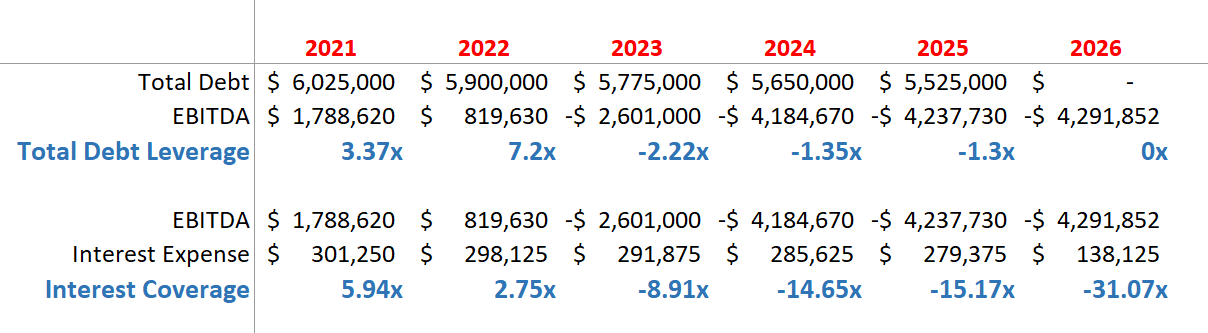

FINANCIAL SUMMARY IN YEAR 0

Positive EBITDA in Year 0 but downward trending with dwindling cash position

Revenue - $30.3M

EBITDA - $0.4M

Beginning Cash - $0.5M

Capital Structure…

$5.4M senior bank note with blanket lien on all assets (real estate, inventory, A/R). Balloon payment with 5% coupon

$0.63M sub-ordinated term note, 5 year maturity with 5% coupon

In order to value the debt opportunity we need to look at 3 scenarios - will the company recover? does the company break covenants and the note gets sold through a chapter 11 process to a PNB? or will the company be liquidated?

Please note, I have created an excel model that I use to value distressed debt - please email me at myarmo@newpointadvisors.us & I’ll be happy to send to you. This is where I’m getting my numbers from for this analysis…

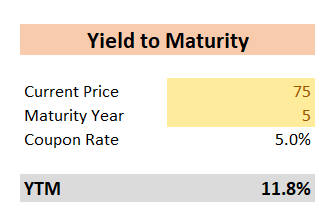

I’ll be using the capital structure of a $5.4M senior banking note & a $625K sub-ordinated note, expiring in 5 years with a 5% coupon. This will be the instrument you’ll be looking to acquire as a distressed investment.

COMPANY RECOVERS

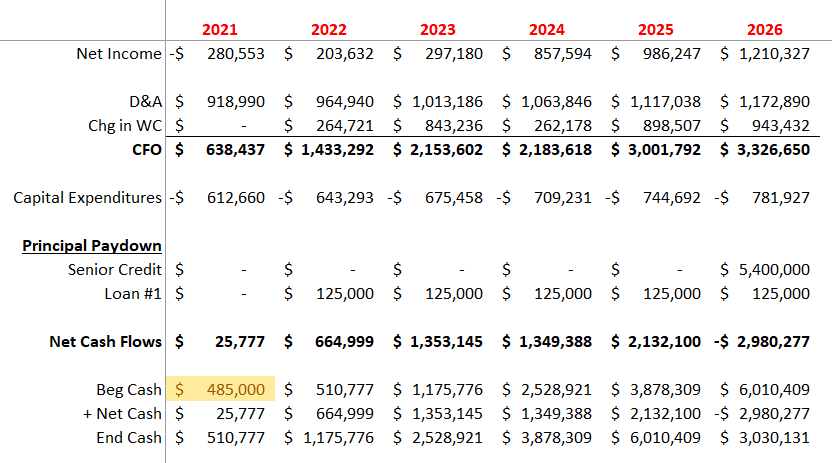

Under this scenario the company recovers as revenue growth resumes & gross margins are able to increase. The company cash flow statement shows that the company will have the liquidity to continue as a going concern

By next year the company is profitable again with the cash flow statement and bank ratios showing the companies ability to pay back both interest and principal…

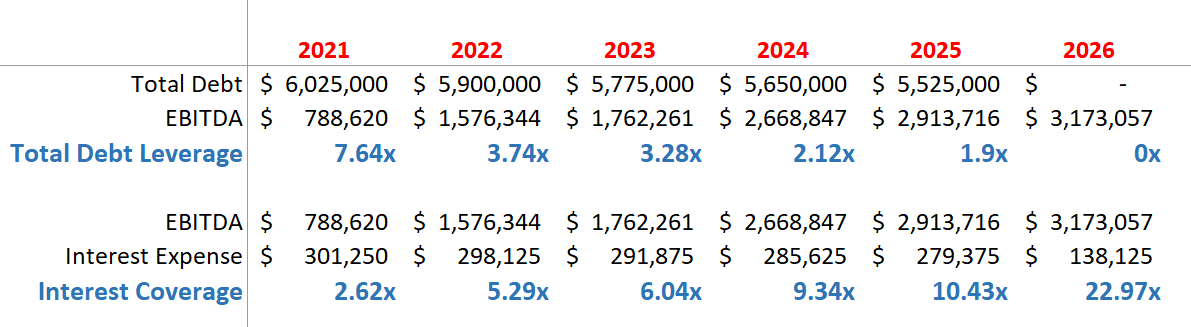

Bank ratios…

Based on these projections both banking covenants will be satisfied and we shouldn’t be concerned with a potential foreclosure on the bank note ($5.25M in 2021).

A return of 11.8% is a strong yield, on the subordinated note, for yield starved investors and now you have done your analysis to show that the sub-ordinated note is likely to be brought to maturity. You’d look to buy the note at 75 cents on the dollar to earn this YTM.

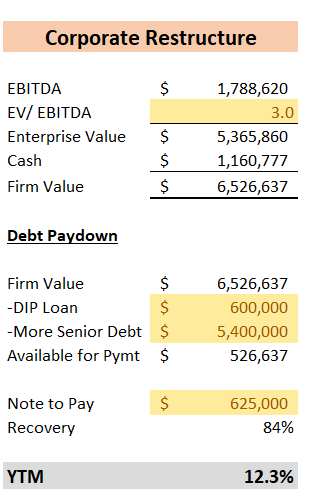

COMPANY SOLD VIA CHAPTER 11

In this scenario, your analysis shows that margins will be significantly squeezed by new entrants and commodity increases. The impact will be a breach of the bank covenants, to the point where the senior creditor will force a liquidation of the business to save their principal amount.

Bank Ratios…

By 2023, the company will become unprofitable and the cash balance will run out. A covenant violation means that the bank (senior lender) has the ability to foreclose the loan, which you should expect them to do, especially with many nervous credit committees looking at their portfolio positions, post-COVID.

If the bank tries to foreclose the loan, the company will have no choice but to file for creditor protection because it won’t have the cash position to repay or the assets to refinance. Therefore, the loan would be sold to a professional note buyer (PNB) who would see value if the company could be fixed. So what happens to the sub-ordinated note as a result of the fix? Let’s assume the company can be repaired back to current year EBITDA…

As you can see, we are using a 3.0x valuation multiple to find the Firm Value. Once we less any DIP loan & the senior note, the recovery is 84% of the $625K note value. However, if we can pay 75 cents on the dollar or less for this note, then the YTM is actually quite attractive!!

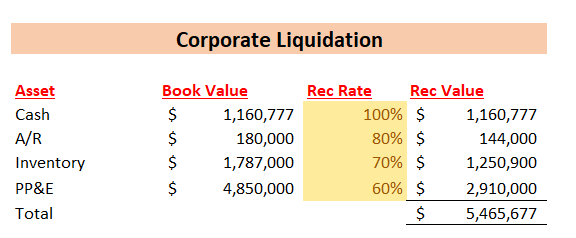

COMPANY LIQUIDATED VIA CHAPTER 7

Lastly, we have the worst case scenario - the company can’t find a PNB for it’s senior note after falling into distress (the prior example had a PNB acquire the note from the lending bank). Therefore, the next step in the process is a chapter 7 liquidation. How do we assess this situation?

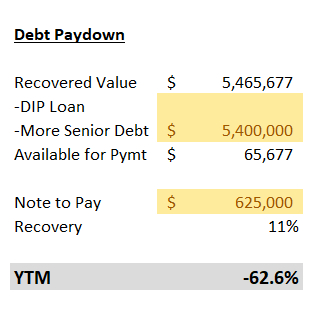

Before considering the outstanding loans, the recovery value of all assets are $5.5M using fairly common recovery rate %’s. This would be used to pay down the more senior creditors ahead in the debt stack before the subordinated note gets anything.

With an only 11% recovery rate, the YTM is a hard pass at a 75 cents on the dollar acquisition. In fact, no scenario would work to make this YTM work in our favor. It’s easy to see here that this distressed note does have a risk component that you’d have to be comfortable with. You are taking the risk that a chapter 7 scenario will not occur. The calculus you’d want to do here is —> will the senior note be sold in the market should the distress continue? If yes, then this is a great investment. If not, then you’ll be looking at a huge loss in capital.

Again, all these calculations are pulled from an excel calculator that I use for all our transactions. I’m happy to send it to you, just leave a comment in the article or fire me off an email at myarmo@newpointadvisors.us.

Thanks so much for this - would you mind emailing me the excel?

Good article pls email the excel