First off, I’ve been quiet over the past few months with this newsletter. With the birth of our first child and acting as CRO for 5 companies, I’ve been struggling to find the time to do anything outside of work and being a new dad, let alone writing a newsletter. So thanks for sticking with me, more content is coming!!

On 01.04.22, I tweeted…

There was a strong response to learn more about what a balance sheet turnaround is so this is a great place to start.

BALANCE SHEET VS INCOME STATEMENT TURNAROUND

Throughout this article I’ll use the term “turnaround” interchangeably with “distress”. In both cases you have a going concern experiencing a certain level of pressure from key stakeholders, such as a secured creditor to stay current with financial obligations. However, the nuanced difference is…

TURNAROUND = DISTRESS + PLAN (often led by PE or Turnaround Professional)

BALANCE SHEET (B/S) TURNAROUND

A B/S Turnaround is simply a balance sheet that is over-levered relative to what the operations, in the near future, can support. I highlight “near future” here because creditors will be reviewing the business on a quarterly basis to see if the company is meeting it’s debt covenants. Even if the company is profitable and throwing off cash, if it has too much debt relative to the cash it generates over the next 13 weeks, then a creditor may consider the loan impaired, putting the company into a distressed situation.

INCOME STATEMENT (I/S) TURNAROUND

An I/S Turnaround takes a B/S turnaround and adds a troubled operations to the mix. In this situation, you are fighting a two front war - repair the balance sheet with new capital and pull the operations out of a nose dive, by bringing it back to a cash flow positive entity. This process can take many months to years and often requires the support from creditors who will consider; “are you the right person to lead the turnaround?”, “is bankruptcy/ selling the note a better option?”, “how viable is your turnaround plan & will it satisfy the debt covenants?

I would leave an I/S turnaround to the professionals, these are tricky!

HOW TO SPOT A DISTRESSED BALANCE SHEET

Distressed investing can be a psychological game. Many times, owners won’t consider their businesses distressed until the senior creditor sends a strongly worded letter using their attorney’s letterhead, threatening future action. You are unlikely to find a balance sheet turnaround situation on bizbuysell.com because the going concern operations are still very much in tact, creating the PERCEPTION that the company is in good standing. We often find that a balance sheet turnaround is a short moment in time between —> a company in compliance with debt obligations and an income statement turnaround. Little action is often taken by most ownership (and frankly senior creditors) until that window has closed. I’ve seen too many times, a company with strong internal controls and a brand moat break down quickly once the liquidity dries up. Once they’ve past that Rubicon, they’ll have entered I/S turnaround land, which you want to avoid.

Here is where the psychological game comes in; it’s your job to identify the FUTURE impact on operations caused by an over levered balance sheet and why it’s in the best interest of ownership now to accept your capital before it becomes an I/S turnaround. You see, an B/S turnaround situation could lead to some ownership dilution but an I/S turnaround is very likely to them losing control or worse, the company altogether.

What the main driver of a company in a B/S turnaround situation? Management believes the company can grow significantly from t=0, borrows money to finance it but that growth doesn’t materialize. Here is an example (based on a real case)…

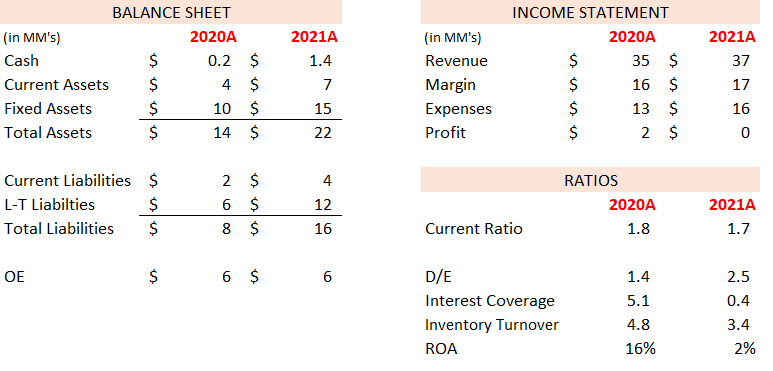

Things to note…

Company was profitable & growing with $35M Rev + $2M Profit in 2020 combined with a strong balance sheet, in compliance with all debt covenants

In early 2020, management saw opportunities for big future growth (not materiality impacted by COVID) and borrowed another $7M to buy more fixed assets + working capital + OV. All loans were term loans, paying out the range of 7.5% - 10% annually

In 2021, expected growth didn’t materialize, and the company only grew revenue to $37M vs. expected growth of $45M with profitability evaporating under the weight of increased OV + interest costs

At end of 2021, the company wasn’t in distress but had ratios that were no longer in compliance, with the senior creditor asking for future projections to ensure liquidity would still be available to satisfy the loan obligations

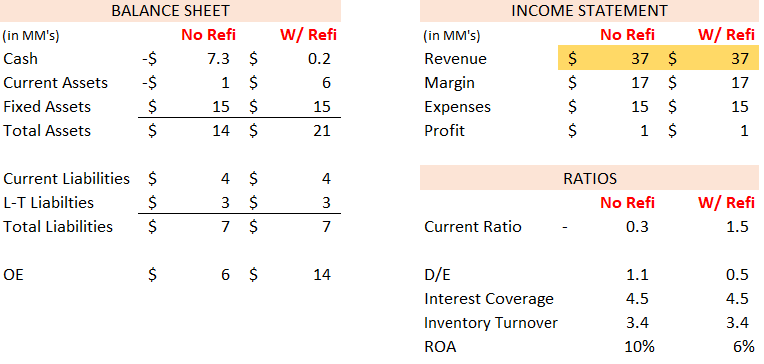

Let’s look forward, to 2022 and test out a couple of scenarios (A vs B)...

Under Scenario A; no revenue growth, cash is underwater → term loans won’t be able to serviced without additional liquidity (YOUR OPPORTUNITY)

Under Scenario B; revenue growth back to initial expectations → profitability has returned and in compliance with debt covenants. However, the pressure is on the management team to achieve this number. This company has never achieved this much revenue growth in one year so the risk is high and creditors are weary

Therefore, the key takeaways here…

balance sheet turnaround opportunity exists within a short window of time before they become an income statement turnaround

psychology dominates and you’ll need to look forward to show why new capital will prevent future liquidity crunch + potential drastic actions from the senior creditors

It’s very likely that management will need lot of new revenue in a short period of time to keep the loans in compliance

Your capital (structure discussed below) will allow management to keep control of business and give them the gift of time to realize revenue growth

HOW TO STRUCTURE NEW CAPTIAL

In the above example, I have argued that this company is on “borrowed” time with the senior creditor who is likely getting nervous by the companies lack of profitability and non-compliance with debt covenants. This loan may or may not move to special assets banking (which would accelerate the drive for more capital) but in all likelihood would be getting more eyes from credit analysts, who would be looking for financial projections to see how long the company can remain solvent.

Your opportunity is to make the balance sheet problem go away before it has a chance of hurting the operations of the company. Time to put your psychology cap on and convince management why your capital is necessary!

How much capital is required?

That depends on the senior creditors willingness to stay in the game but let’s assume they want to reduce their exposure to $3M, from $12M

Firstly, we’d need to understand what are the debt covenants. Let’s assume a very simple example using Debt to Equity of <2.0 and Interest Coverage Ratio of >3.0. Please note often Fixed Charge Coverage Ratio is a common covenant and loan documents could contain many more ratios

Secondly, let’s model this by using these 2 basic covenant metrics, no revenue growth & a $3M senior loan outstanding…

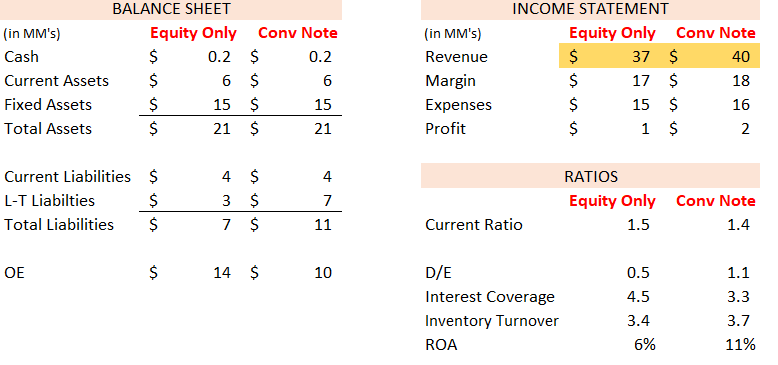

A $7.5M capital injection would be needed to support the solvency ratios/ debt covenants and to clear the -$7.3M in negative cash (& thus the current ratio) created by the senior lender reducing exposure. In the above example the $7.5M came in all as equity but could we do a subordinated convertible note that would keep a senior creditor content?

Based on the modelling, yes the company could support some type of hybrid financing option but only with quick revenue growth. Therefore, if you as an investor, wanted to reduce risk with a $2.5M equity + $4.0M 10% convertible note injection compared to coming in with $7M cash and being only common stock, the ratios do hold up. The senior creditor would be satisfied with the covenants and enough assets to cover the possibility of a liquidation. However you’ll want to make sure the revenue is a guaranteed with a new customer contract, a sales order, unaccrued subscriber revenue or new points of distribution.

This should be a good start to understanding…

what is a B/S turnaround

how it differs from an I/S turnaround

how to spot a B/S turnaround based on ratios and the financial statements

how to finance a B/S turnaround

In future articles, I’ll write more on how to value a B/S turnaround + the psychology of selling yourself to a owner who may not believe themselves to be in distress.

Feel free to reach out to mike.yarmo@claritiadvisors.com if you have additional questions.

Hey! Love the articles. Thank you for taking the time to write these.

What is OV you mention?